We have formalised our Fundamental Research approach to combine these important aspects:

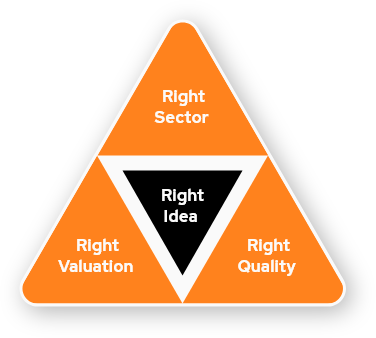

This brings us the 3R Research Philosophy, which enhances the effectiveness of an investment idea and helps us make right decisions for long-term investments. The 3R Research Philosophy involves the deep analysis of three matrixes: Right sector, Right quality and Right valuation. These form the foundation to generating the Right investment ideas for Mirae Asset Sharekhan’s Fundamental Research Team.

Isolating sectors with strong growth prospects from the long-term perspective

Favorable industry structure, big runway for growth, huge opportunity size, high entry barrier and relatively immune to government policies

Management excellence with strong business fundamentals

Sustained competitive advantage; sound business strategy, integrity and transparent management; and portraying great execution through sustained strong financial performance.

Buying good businesses at sensible prices

Using different valuation methods such as PEG, DCF and relative valuation to get sensible values; determining the right time to investment by comparing current valuation to historical PE band / peer valuation

Long-term Strategy

Wide Coverage with Continuous Monitoring

New Opportunities

Stock Follow-ups

Weeding Out Bad Stocks

Simple and actionable insights

Choose from among a variety of actionable, in-depth Research packages and get access to 20+ regular Research reports.

EXPLORE RESEARCH REPORTS