June 2, 2023

We are pleased to roll out the EMF Spot Incentive Plan – June 2023 for the Super Trader, Super Investor, Sharekhan One and Retail Relationship Managers (RMs) and Customer Relationship Executives (CREs). The incentive plan seeks to reward these front-line Sherus for helping clients get more returns by investing less with the Exchange Margin Funding (EMF) tool.

Targets and rewards for Super Trader and Super Investor RMs of the service branches (from a minimum of three clients)

| New Funding | % of new funding done | Max. Reward Amt (Rs.) |

| Min Rs.5 lakh – Rs.10 lakh | 0.125% | 1,250 |

| >Rs.10 lakh - Rs25 lacs | 0.15% | 3,750 |

| >Rs.25 lakh and above | 0.20% | 20,000 |

Targets and rewards for Retail RMs and CREs of the service branches (from a minimum of five clients)

| New Funding | % of new funding done | Max. Reward Amt* (Rs.) |

| Min Rs.3 lakh – Rs.10 lakh | 0.125% | 1,250 |

| >Rs.10 lakh – Rs.25 lakh | 0.15% | 3,750 |

| >Rs.25 lakh and above | 0.20% | 20,000 |

Targets and rewards for RMs of Sharekhan One branches (from a minimum of three clients)

| New Funding | % of new funding done | Max. Reward Amt* (Rs.) |

| Min. Rs.15 lakh – Rs.50 lakh | 0.075% | 3,750 |

| >Rs.50 lakh – Rs.75 lakh | 0.10% | 7,500 |

| >Rs.75 lakh and above | 0.125% | 25,000 |

* The maximum reward (upper cap) per RM cannot exceed Rs.20,000 per month for the service branches and Rs.25,000 per month for the Sharekhan One branches.

Terms and eligibility criteria of the incentive plan for RMs and CREs

- Clients should be newly introduced to the EMF system or should not have been active in EMF during the period January 1 to May 31, 2023 to be eligible for the scheme.

- The average effective minimum monthly funding should be Rs.5 lakh per Super Trader and Super Investor RM, Rs.3 lakh per CRE and Rs.15 lakh per Sharekhan One RM.

- A minimum of 3 clients should be enrolled per Super Trader, Super Investor and Sharekhan One RM and a minimum of 5 clients should be enrolled per CRE, using the funding as mentioned in the slabs above.

- The average interest yield should be a minimum 11.50% per RM across all eligible clients.

- Effective EMF funding means debit in EMF less credit in broking, if any (on actual funding utilisation).

- Funding will be calculated inversely on actual interest generated in the EMF segment on a monthly basis.

- The scheme is valid for the month of June 2023, ie with effect from June 1 to June 30, 2023.

- The incentive will be calculated and provided for the month based on the slabs given Above.

Recognition for BMs

The top 20 Branch Managers (BMs) will be recognised with a certificate of appreciation based on new funding collected during the period of the scheme subject to a minimum funding of Rs.50 lakh or above.

Conditions of the incentive plan

- The incentive cannot exceed more than the interest revenue from the clients.

- Clients buying through EMF will need to mandatory authorise the pledge confirmation link (before 12 noon on T+1) as per the existing process to be considered for funding.

- NRI clients are not eligible for EMF funding.

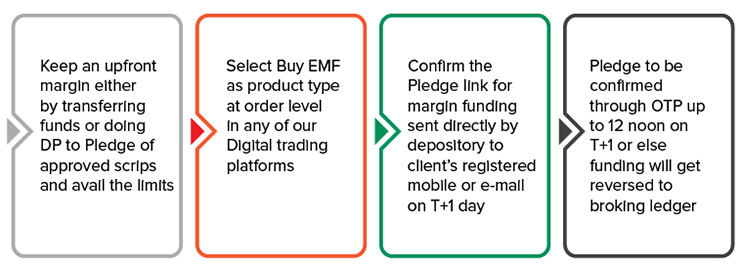

We have explained the EMF process below for your benefit. A better understanding of the pledging process will allow you to help clients complete the EMF funding transactions smoothly.

Process to be followed for EMF funding

NOTE: Clients can also confirm a pledge on T+1 day before 12 noon by clicking the standard pledge link for margin funding given below in case they do not receive the link directly from the depository due to any error or technical issue:

To authorise a pledge on NSDL, click here

To authorise a pledge on CDSL, click here

| Join us on |