Having trouble viewing this e-mailer? Click here >

Dear Customer,

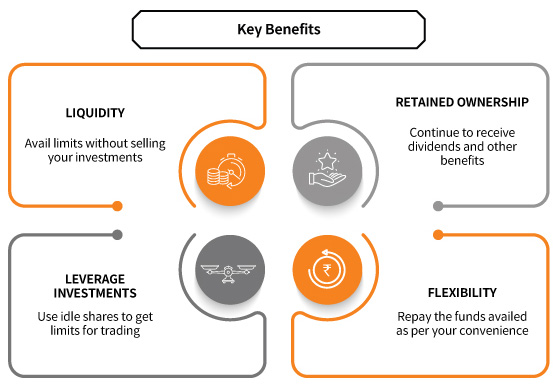

You must already be aware of Instant DP To Pledge, a unique utility that allows you to pledge stocks held in your DP to avail instant limits for trading.

Well, here’s some more good news for you – you can now use this to avail limits for Commodities too!

This means that you can now pledge your equity holdings to get limits for trading in Commodities segment.

So, don’t miss out on this cool way to get limits and trade more without delays.

|

|

|

With reference to SEBI circular no. SEBI/HO/MRD2/DCAP/P/CIR/2022/60, to keep overnight exposure in the Commodity Derivative markets, the mandate is to maintain margin at a minimum of 50% cash (and cash equivalent collaterals) and 50% can be kept in the form of Pledged Securities (post haircut). Thus far, you have been given an exception from the above rule and non-cash component in excess of 50% of margin requirement was accepted without any interest cost. However, going forward, non-maintenance of 50% cash margin (cash & cash equivalent), will attract interest costs.

We are also happy to inform you that we have upgraded our systems and any pledged collateral that is eligible as cash component (as notified via Exchange circulars released from time to time) would be considered as cash component in the above computation.

Note on Interest Rates: Stock collateral credit is restricted to 50% of the margin or value of collateral, whichever is lower, for stocks used as margin for Derivative trades. You may check brokerage, demat and other charges by clicking here.

Disclaimer:

Click here for detailed Disclaimer and SEBI Registration Details.

Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please refer the Risk Disclosure Document issued by SEBI and go through the Rights and Obligations and Do’s and Dont’s issued by Stock Exchanges and Depositories before trading on the Stock Exchanges.

This information is only for consumption by the client, and such material should not be redistributed.

Stockbrokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Update your MOBILE NUMBER & EMAIL ID with Mirae Asset Sharekhan and receive OTP directly from us on your email id and/or mobile number to create pledge.

Pay minimum 20% upfront margin of the transaction value to trade in cash market segment. Investors may refer to the Exchange's Frequently Asked Questions (FAQs) issued vide NSE circular reference NSE/INSP/45191 dated July 31, 2020; BSE Notice no. 20200731-7 dated July 31, 2020 and NSE Circular Reference No. NSE/INSP/45534 dated August 31, 2020; BSE Notice No. 20200831-45 dated August 31, 2020 and other guidelines issued from time to time in this regard. Check your Securities /MF/ Bonds in the consolidated account statement issued by Mirae Asset Sharekhan’ s NSDL/CDSL every month.

In case of an online demat and trading account offered by Mirae Asset Sharekhan, the request can be made online. The customer needs to select the shares and their quantity to be pledged and submit the online request.

- Pledge requests are processed in batches at pre-decided time slots by the clearing corporation.

- Customers need to carry out this activity of pledge authentication for all the shares that were earlier placed for margin with the broker.

Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please refer the Risk Disclosure Document issued by SEBI and go through the Rights and Obligations and Do’s and Don’ts issued by Stock Exchanges and Depositories before trading on the Stock Exchanges. Commodities Derivatives are highly leveraged instruments and riskier than equities, so you are requested to do your own due diligence before opting for this option for availing margin in commodities segment.

This document has been prepared by Sharekhan Limited (Sharekhan) and is meant for sole use by the recipient and not for circulation. The information contained herein is intended for general information purposes only. The information published should not be used as a substitute for any form of investment advertisement, investment advice or investment information. The information herein has not been prepared considering specific investment objectives, financial situations and needs of any investor, and therefore may not be suitable for you.