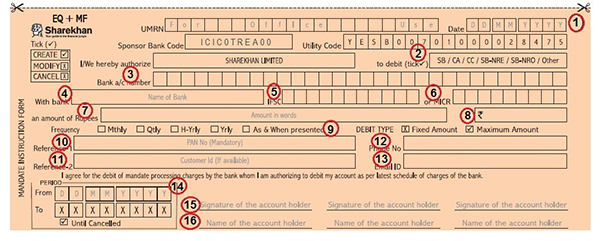

A customer can avail of the Automated Clearing House (ACH) payment facility by filling up and signing the ACH mandate form. At the time of collecting the ACH mandate from a customer, ensure the form is duly filled and signed. To help you with the process, we have explained the form below. Each field of the form has been assigned a number and the check-list has the corresponding instructions. This will help you ensure that customers provide all the information required for a smooth activation experience.

Help a customer fill the ACH mandate form

The ACH mandate form

Instructions for each field of the ACH mandate form

- The current date on the form should be mentioned in the DD/MM/YYYY format only

- The Debit Bank Type section should be ticked

- The client’s bank account number should be mentioned

- Customer bank name should be mentioned

- The Customer bank’s 11-digit IFS Code should be mentioned

- The Customer bank’s nine-digit MICR Code should be mentioned (he can find it on his cheque leaf)

- The amount should be mentioned in words and match the amount mentioned in numbers

- The amount should be mentioned in numbers and match the amount mentioned in words

- The Frequency Type section should be ticked at “As & When presented”

- The client’s PAN should be mentioned in capital letters only (it's a mandatory field)

- The customer ID should be mentioned (in case he does not know it, tell him to leave the field blank, we will update it)

- The customers contact number registered with Sharekhan should be mentioned in order for us to keep him updated on his account and send him important alerts and notifications

- The Customer e-mail ID registered with Sharekhan should be mentioned in order for us to keep him updated on his account and send him important alerts and notifications

- The mandate start date should be same as the current date as mentioned in point number 1 in the DD/MM/YYYY format

- All account holders should sign the form as per the bank records

- The names of all account holders should be mentioned as per the bank records

How the ACH mandate works explained with an example

| Registered ACH amount (Rs.) | 2,000/- | 5,000/- | 20,000/- | 50,000/- |

| Can register maximum amount per SIP (Rs.) | 2,000/- | 5,000/- | 20,000/- | 50,000/- |

| Remark | Cannot register a single SIP of more than Rs.2,000 | Cannot register a single SIP of more than Rs.5,000 | Cannot register a single SIP of more than Rs.20,000 | Cannot register a single SIP of more than Rs.50,000 |

| Rs.2,000 x 5 SIPs | Yes | Yes | Yes | Yes |

| Rs.5,000 x 5 SIPs | No | Yes | Yes | Yes |

| Rs.10,000 x 5 SIPs | No | No | Yes | Yes |

| Rs.20,000 x 5 SIPs | No | No | Yes | Yes |

| Rs.50,000 x 5 SIPs | No | No | No | Yes |

In the above example, the number of SIP mentioned is only indicative, a customer may register any number of SIPs.

The minimum ACH registration amount should be Rs.2,000. In case a customer gives a mandate for a greater amount, only the registered SIP amount will be debited from his bank. Advise customers to register for the maximum amount through the ACH mandate as it is a one-time process and will help him to register SIPs of higher values in future.

Where to submit an ACH mandate?

Once you collect the ACH mandate from a customer, check it again for the following:

- The minimum amount per transaction should be mentioned

- The signatures of the customer and all the account holders should be as per bank records.

If everything is duly filled, print the mandate at 100% scale and send it to the head office.

- If the mandate is from a new customer

Send the ACH mandate along with the account opening form to the Account Opening department through your branch only. - If the mandate is from an old customer

Send the ACH mandate to the Mutual Fund Operations department at the following address. Also, prior to the submission of ACH Mandate form, ensure CIS maker entry

Sharekhan Limited

HO- Mutual Fund Ops Dept.

ACH-NACH Team, 4th Floor,

Jolly Board Tower - D Wing,

I-Think Techno Campus, Kanjurmarg (East),

Mumbai – 400042

| READ DISCLAIMER |

| Published by Team Internal Communications |  |

| Join us on |