For private circulation only |

March 6, 2020 |

|

|

- The daily average brokerage up 4% in February 2020

- Brokerage up 13% compared to 2019 at the year-till-date level

- The daily client activity rises 3%

- 645 clients added on a daily basis

In February we registered our 20,00,000th customer in the Bengaluru branch. Yes, we now serve 2 million customers across the country and that’s huge. New client additions remain consistent and the credit for our steadily growing client base goes to the Client Acquisition team, which has maintained productivity despite downsizing, as well as the Relationship Managers (RMs) and Customer Relationship Executives (CREs). Notably, the RM and CRE channel alone added a record number of 1,189 new customers in January this year. The RMs and CREs have been constantly growing our new account opening count since July last year and have done a commendable job. The daily client activity has shown a growth for three months in a row, thanks to the Front Foot Programme (FFP), which has not only brought back many clients but also ensured that they remain active. More on this later. Meanwhile, the performance of the other businesses was lacklustre, here’s hoping these pick up momentum fast.

|

|

|

|

Twenty twenty is a big and exciting year for Sharekhan. On February 8 we celebrated the 20th anniversary of the organisation. We are proud to complete two decades in the financial service business. It has been an amazing journey and I have been privileged to witness the Tiger’s evolution from a start-up into India’s number one non-banking full service broker. The year also marks the beginning of the last leg of our Vision 2020 plan. Completing all Vision 2020 goals will be a priority this year and we will soon come out with a plan to make the final year of Vision 2020 a huge success. The targets and key performance indicators for 2020 too will be announced soon.

Just as we look back with nostalgia and pride, we look forward to the future with great anticipation. We are already in the process of finalising our next four-year growth plan, Vision 2024. The focus areas of the plan have been identified as Project Leap, Project Sharekhan 2.0, Project Do It Yourself, asset gathering and complete integration with the BNP Paribas Group in terms of Compliance, Risk, Operational Permanent Control and Cyber Security. The details of Vision 2024 will be shared with you soon, so stay tuned. Sherus, let us make 2020 a great year for all — customers, staff and business partners.

|

|

|

|

The assets under management (AUM) for the mutual fund (MF) distribution business in 2020 (year till date, until February 2020) declined by 1.4% to Rs.3,739 crore affected by a weak equity market performance (the Nifty 50 Index declined by 8% during this period). As we move forward to achieve an ambitious target in 2020, we look to drive the MF business through RMs, CREs, Sales Executives, Onboarding Executives, Investment Specialists and Mutual Fund Specialists across branches. To reward these front-line Sherus, we rolled out an incentive plan along with the Key Performance Indicators (KPIs) for 2020 in January this year. We also revamped the mutual fund MIS formats to support and drive the KPIs and incentive plans. The revamped reports are simple and easy to understand, designed to help the Sherus achieve their targets and drive the business.

|

|

|

|

The AUM for our Portfolio Management Service (PMS) business crossed Rs.100 crore in February 2020, almost doubling since October 2019. The growth can be attributed to various factors including the move to offer the PMS products through the Investment Solutions team, the renewed focus of the branch network on PMS products, regulatory impact (an increase in the minimum threshold from Rs.25 lakh to Rs.50 lakh pushed many investors to invest in January this year) and a strong performance of our portfolios, Sharp PMS and Prime Picks.

|

|

|

|

The daily turnover from AlgoScalp crossed Rs.300 crore on February 1, 2020, reflecting the growing popularity of AlgoScalp, an algorithmic trading-based scalping system. Scalping works in most market conditions and we have used the strategy for customers in the past. Last June, we created an automated trading system based on the scalping strategy and rolled it out under the brand AlgoScalp after obtaining all regulatory approvals. AlgoScalp has potential and I urge all RMs to recommend it to those customers who prefer simple trading strategies, have a high risk appetite, want to make a small profit on each trade, chose to book profits (or losses) using an automated algorithmic system or prefer a strict exit strategy. The product offers many benefits to the RMs too. They don’t need to monitor the markets continuously as trades are executed automatically and reporting is done from the head office. The RMs, thus, save time for other, more important tasks. AlgoScalp also reduces the chance of human errors. Plus, all orders are double checked by the software to ensure everything is proper. I congratulate Anup Chandak and the rest of the AlgoScalp team for doing a great job. I thank everyone who has contributed to the success of AlgoScalp, especially Hemang Jani and GK. I know the two have worked hard to make this happen. Good show, guys! Let us now keep up the momentum.

|

|

|

|

We launched the Unified Payments Interface (UPI) on all trading platforms, including Sharekhan App, sharekhan.com, TradeTiger and Sharekhan Mini, on January 17 this year. The roll-out of the real-time payment system comes within six months of launching the UPI facility for subscribing to public issues online. The roll-out of UPI has reduced the number of steps needed by a customer to transfer money from his bank account to his Sharekhan trading account. The customer is not required to enter the OTP (one-time password) for the bank transaction. He also does not need to visit the website of his bank to do the transaction. All he needs to do is to use his UPI ID. He stays on the Sharekhan site, the transaction is quick and the experience is smooth. We have tied up with a third-party service provider, Razorpay, to offer the facility.

We also introduced the Trade Listing Summary feature on the website on January 8 this year. It is a comprehensible report that summarises the trades carried out by a customer and gives details, such as the cost, brokerage and other charges paid by him for the trades. With the report customers can now easily track their trades of the last two years along with the brokerage and taxes paid by them. They can also see the report year-wise as well as day-wise by using the Calendar option. The Trade Listing Summary reports can be downloaded in MS Excel and PDF forms, and customers can also easily print them without downloading them. I congratulate the Digital Initiatives team led by Chandresh Khona for continuing with the company’s technology advancement agenda.

|

|

|

|

The recently concluded initial public offering (IPO) of SBI Cards and Payment Services (SBI Cards) received a tremendous response from customers and was overall subscribed 26.49 times. As many as 68,000 customers applied for the IPO through our IPO Online facility and we collected bids worth Rs.3,212 crore. The success of the IPO can be attributed to two key factors. First, as the second largest card issuer of India and subsidiary of State Bank of India (SBI; the country’s largest commercial bank in terms of deposits, advances and the number of branches), SBI Cards has captured the imagination of customers. The second factor, and more pertinent in our context, is the ease of subscription, thanks to the availability of UPI, which allows customers to apply for IPOs online again. Ever since we integrated UPI with our digital trading platforms our IPO business has picked up. We recorded a solid gain of 150% in customer participation in the SBI Cards IPO compared with the Ujjivan Small Finance Bank IPO. Here’s a pat on the back of Pravin Darji and the rest of the IPO team, the PDG team, Amit Arora and the IT squad for making this possible.

|

|

|

|

The AUM of our Exchange Margin Funding (EMF) business crossed Rs.200 crore this year. It is a big milestone. We have been crossing milestones one after another in the EMF business ever since we launched the EMF Online facility on all our digital platforms, including Sharekhan App, TradeTiger, sharekhan.com and Sharekhan Mini, in July last year. By making application for EMF easy and promoting it well internally and among customers, we have successfully revitalised the business. The new feature, EMF Online, improves the customer experience by making borrowing for fresh equity purchase convenient and faster. Customers are slowly and steadily reaching out for the facility. After crossing the 20,000-mark in December last year, the number of customers registered for EMF has now risen to 26,438. The EMF and IT teams both have done a good job of reviving the business. Way to go!

|

|

|

|

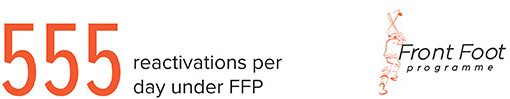

Along with the new clients, many old clients are also coming back, thanks to FFP. The Network team has reactivated 62,000 clients in 112 trading days since the launch of FFP in September last year. The programme also saw many successes in Sharekhan’s 20th anniversary month. In February, certain clusters activated more than 200 clients in a single day. Similarly, specific branches strategised and hit 100+ reactivations in a single day during the month. The cluster led by Hemendra Agarwal completed the milestone of an overall 10,000 reactivations under FFP so far. The clusters led by Mustafa Pardiwala, Rajiv Purohit, Anahita Vora and Channaraj contributed a daily average reactivation count of 60+. The highest daily number for a cluster was 434 reactivations on February 7, achieved by the cluster led by Nidhi Ticku. Well played, Network!

The brilliant efforts of our RMs and CREs have also ensured that the clients remain active once they are back in the fold. The 112-day average revenue per reactivated client stands at Rs.1,100. The revenue contribution of the reactivated clients to the February brokerage revenue was a good number at Rs.2.09 crore. In March, the FFP team aims to achieve new heights with the SBI Cards IPO presenting a big opportunity.

|

|

|

|

This year is also remarkable because we will be reinforcing the values of positive management across the organisation and have planned some enriching activities to achieve this. Ranging from panel discussions around the five key pillars of positive management to training sessions around specific themes designed exclusively for our branch managers as well as some chosen ones from various departments, these activities will focus on enabling the participants to strengthen the Sheru community and build a more inclusive work environment. It is an important initiative, which requires commitment and support from each of us and will help continue to make Sharekhan a great place to work.

|

|

|