For private circulation only |

February 15, 2023 |

|

|

Dear Sheru,

I hope the new year has started on a good note for you. In spite of our many achievements, 2022 was challenging for the company as our performance dipped in some areas compared with 2021, which was exceptionally good, the best year for Sharekhan so far. Obviously, we need to work harder and smarter in 2023 to regain the lost ground as well as to reach our goals for the year. The goals will be defined by our Vision 2025 strategy. In my previous column, I mentioned the priorities for our various businesses in the new year. Today, I will also talk about the lessons we learnt while implementing the recommendations of the Vision 2025 plan in 2022 and the priorities these lessons have determined for this year. I look forward to your continued support and commitment to achieving Vision 2025 and wish you all tremendous success in the year ahead.

|

| Performance in 2022 |

|

| Vision 2025 update |

|

|

There is a whole lot to do, from designing a logo for our Sankalp project to announcing our Vision 2025 goals for the year and working on them. But before we get down to all that, let us quickly take a look at the lessons learnt in 2022 and the priorities for 2023.

| Lessons learnt in 2022 |

|

Priorities for 2023 |

- We need more frequent communication/engagement time at various levels to onboard all Sherus on Vision 2025 and update them on the progress of the Vision 2025 projects.

- With a fast-changing industry and a competitive environment, along with marginal changes we would also need some bold moves to achieve our strategic objectives.

- Our core strategic goals would need more dedicated efforts and resources to make a significant difference.

- We need to be more focussed in our approach.

|

- Clearly define and communicate the strategic KPIs to be delivered by each team in order to align the same with the company’s business goals.

- Adapt to the Sharekhan culture that puts the financial wellbeing of customers at the core of the organisation's DNA.

- Become more employee-centric and enable Sherus to serve customers effectively, that’s a sure-shot way to improve the customer experience.

- Systematically compete with the disruptors and win back our market share in the broking business.

- Renew the focus on the asset business to help us transform and achieve our ambitious targets as per Vision 2025.

- Increase collaboration among different teams as well as between the Branch Network and the Head Office.

|

|

|

| December 2022 update |

|

|

|

- In the equity broking business, our daily average revenue grew by 6% MoM in December 2022.

- In the equity broking business, new client additions grew by 8% MoM in December 2022.

- The TTM active client count was at 7,49,880 at the end of December 2022 -- though less than our November 2022-end number, the performance on this metric (in % of growth/decline terms) was relatively better than that of both the overall industry and the largest broker in the full-service broking category.

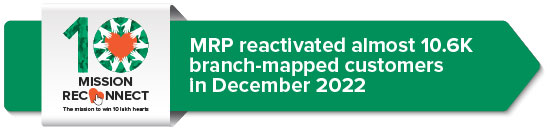

- Close to 10.6K branch-mapped broking clients were reactivated as part of the MRP in December 2022.

- Our EMF AUM increased by nearly 2% MoM in December 2022.

- We launched our annual performance appraisal exercise in December 2022.

|

|

|

|

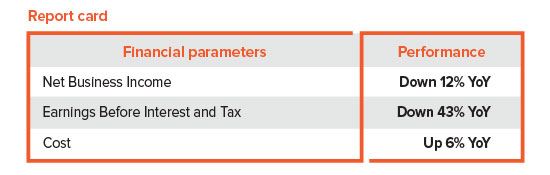

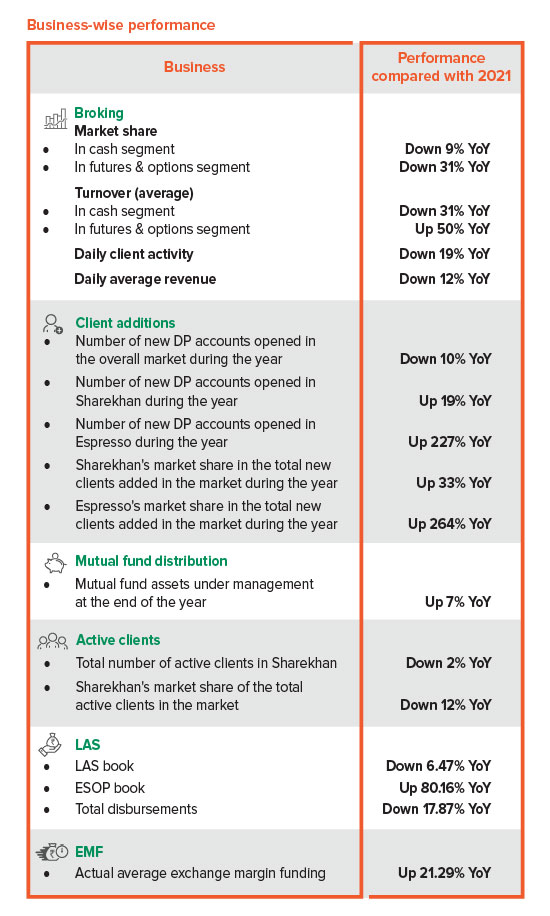

After gaining by more than 4% month on month (MoM) in November 2022, the Indian equity market ended December 2022 on a negative note with the Nifty and the Sensex down 3.5% each MoM. Against this backdrop, our performance for the month reflected resilience as we maintained our market share in the cash and futures & options segments; increased our daily average revenue by 6% MoM; and expanded our customer base by 8% MoM in December 2022. Though we closed the last month of 2022 on a positive note, our performance in 2022 was a whole different story as can be seen from the report card above – in 2022, we lost market share, our cash market turnover plunged, and our daily client activity and daily average revenue both declined. We have a lot of ground to cover in 2023. Here’s wishing you all the best, let us not only regain the lost ground but also achieve new milestones in our broking business in this year.

|

|

|

|

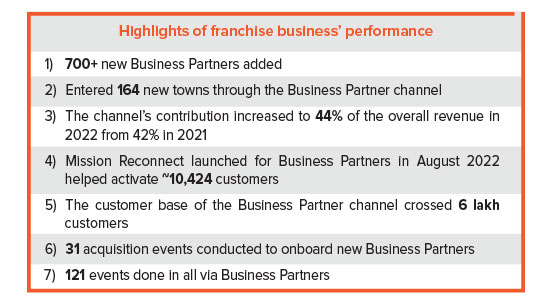

The Mission Reconnect Programme (MRP) had another robust month in December 2022. The trailing 12-month (TTM) active client count was at 7,49,880 at the end of December 2022. Though less than our November 2022-end number, Sharekhan's performance on this metric is relatively better than that of both the overall industry and the largest broker in the full-service broking category. MRP facilitated the reactivation of almost 10.6K branch-mapped clients during the month. What’s more, the efforts of the Business Partners resulted in the reactivation of another 5K clients in the same period. The trend remains that reactivations are also good for revenue growth. Close to 4.3% of the clients who got reactivated in December 2022 have also traded in futures and options already. In addition, a large proportion of the reactivations have continued beyond just one or two transactions. Almost 36% of the reactivations that took place in December 2022 have conducted three or more transactions already. My best wishes to the entire front-line team as well as our Business Partners for the continued success. Let’s take this programme to greater heights in 2023.

|

|

|

|

Our mutual fund (MF) assets under management (AUM) fell marginally by 1% MoM to Rs.6,506 crore in December 2022. The fall was less than the dip recorded by the broader equity market in the same period (the Nifty was down by 3.76% MoM during the month). Sharekhan’s market share has remained constant since September 2022 at 0.16%. The gross inflow for the month stood at Rs.245.02 crore and the net collection was positive at Rs.80.85 crore, which reflects a strong recovery after the net outflows witnessed in the previous month. The inflows into Systematic Investment Plans (SIPs) grew by Rs.11 lakh during the month to Rs.52.03 crore from Rs.51.92 crore in the previous month. In this year, we focus on asset gathering (including SIPs) and product diversification to offer investors new and better investment opportunities across different product lines.

|

|

|

|

Our business of Exchange Margin Funding (EMF) registered a growth of about 2% MoM in December last year. We ended December 2022 with EMF AUM of Rs.1,077 crore. Our Branch Network’s contribution stood at almost 67% of the total funding; our Business Partners accounted for the rest. Let us build on the last year’s performance and achieve some new records in the EMF business this year.

|

|

|

|

Our Loan Against Securities (LAS) and Employee Stock Ownership Plan (ESOP) books contracted by 1.56% MoM and 38.37% MoM in December 2022. Our total disbursements contracted by 42.86% MoM to Rs.87.81 crore in December 2022 primarily on account of the rising interest rates. LAS is another area that will require increased efforts in this year.

Channelwise break-up of LAS disbursements in December 2022

| Channels |

Disbursements |

| Direct channel |

12% |

| Branch Network |

36% |

| Business Partners |

4% |

| Direct selling agents |

44% |

| ESOPs |

4% |

|

|

|

|

In December 2022, our Human Resources (HR) team launched the annual performance review exercise for 2022. All employees (excluding office assistants and electricians) who joined on or before September 30, 2022 are eligible for a performance appraisal. The annual practice of reviewing staff performance offers numerous benefits. It helps improve staff performance, identifies the areas of training, clarifies expectations, evaluates goals, rewards good performance and creates a career growth path. All Sherus must always complete the appraisal exercise on time so that the compensation review process can be completed and the increments can be implemented on time.

|

|

|

|

The COVID situation seems to have normalised. Perhaps it is time to do away this section. Hopefully, it will not reappear in the column.

Take care of yourself and your loved ones, stay safe and have a great 2023.

|

|

|

Thank you.

Best regards,

Jaideep Arora

Director and Chief Executive Officer

Sharekhan

|

|

|

|